Fee Protection Service

What is the Fee Protection Service?

Our Fee Protection Service is an option we offer to our clients to protect them against the costs of a tax enquiry or investigation.

We hold an insurance policy in our name. We make a claim to our insurers when a client that has chosen the service has a tax enquiry.

What’s the chance of me having a tax enquiry?

Anyone can have a tax enquiry and the number of enquiries HMRC are undertaking is increasing. HMRC are also using much more technology to bring together information from lots of different sources. We can’t predict who will get a tax enquiry.

I’ve nothing to hide so I’m not worried.

That’s great (although if we thought you did have something to hide we wouldn’t be your accountant). Unfortunately tax enquiries often follow a set process. Once that process has commenced then HMRC will work their way through the different stages of evidence gathering – often at a painfully slow speed. We currently have one enquiry underway that has been ongoing for more than two years. The taxpayer has done everything correctly, cooperated fully with HMRC and is highly likely to have a successful conclusion but that hasn’t affected the process HMRC are following.

If I do have an enquiry how much will it cost?

We’d charge our hourly rates for dealing with the enquiry. This would usually include:

- Research

- Preparation of letters to HMRC

- Preparation of additional information requested by HMRC

- Meetings with you and HMRC

- Reviewing and agreeing minutes

- Advising of strategy

- Consulting with other tax advisors (and their fees) as appropriate

- Checking HMRC calculations

- Preparing and submitting appeals against HMRC decisions

It is impossible to predict how much an enquiry will cost which is why an insurance scheme makes sense. For details of our hourly rate please ask.

Can I deal with a tax enquiry myself?

There is no legal reason why you can’t deal with your own tax enquiry. However, many people find a tax enquiry quite a stressful experience. It’s probably the time when you need professional help the most.

Will the insurers pay out?

We deal with the insurers and make the claim on our policy. We’ve never had a claim rejected. There are reasons why a claim won’t pay out but we think they’re pretty reasonable conditions. Check ‘The Small Print’ below.

Will the policy pay any tax I owe as a result of an investigation?

No. The policy won’t pay tax, penalties or interest resulting from a tax investigation. The policy will pay our fees in dealing with the investigation on your behalf and give us the best chance of arguing your case with HMRC.

How much does it cost?

Ask us for a quote.

I’m not a client but I’d like the cover.

Sorry. Our Fee Protection Scheme is only available to our clients.

The small print

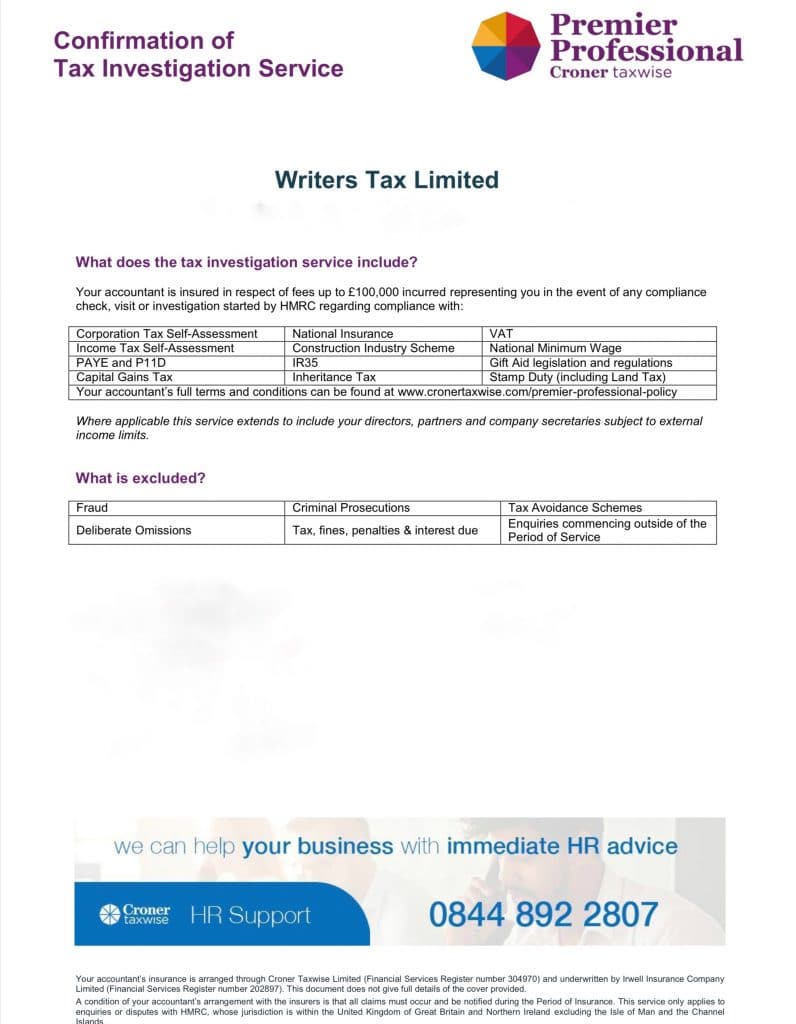

Here’s a copy of the policy information for our current scheme.